"Goldman Sachs is talking about Copper price reaching $6.8 per lb driven by the deficit in the market. "If Copper goes to $6 per lb it will put a few smiles on the faces of people around here", Rob explains. "There is a large gap between supply and demand is developing according to Goldman Sachs. And if China comes back on stream, they are the big buyer of Copper... so we could see that number. I will be very happy as Los Azules is projected to be producing copper at $1.7 per lb."

"Copper hit $10,000 a ton for the first time in two years as speculation builds that the world’s mines will struggle to meet a coming wave of demand from green industries.The metal reclaimed that threshold as a historic squeeze on the supply of mined ores risks tilting the market into a major deficit and as investors turn increasingly optimistic about demand.One headwind to the rally is that Chinese demand is looking alarmingly soft. The disconnect is evident in futures positioning on the London Metal Exchange, where investors have boosted bullish bets to a record while sales by commercial entities have surged.But recent supply challenges and an improving outlook for global usage are emboldening copper bulls like BlackRock Inc. and Trafigura Group, which say the metal will have to jump even higher to spur the construction of new mines." (Mining.com)

"Millions of tons of new supply are set to be needed in coming years for use in electric vehicles, renewable energy and vastly expanded power grids as major mines become harder to find and more expensive to build or expand. BHP Group’s megabid for Anglo American Plc this week highlights that many miners would prefer to buy rivals than pull the trigger on entirely new projects.“It tells you that building stuff is just too expensive,” said Colin Hamilton, managing director for commodities research at BMO Capital Markets in London. “Everyone was expecting that the supply pipeline would have reacted to higher prices by now, and it just hasn’t.”

Copper would need to reach $12,000 a ton to spur large-scale investments in new mines and stave off future deficits, Olivia Markham, who co-manages the BlackRock World Mining Trust, said in an interview earlier this week." (Mining.com)

TNR Gold NSR Royalty Holding, Rob McEwen: "Los Azules Copper - Equivalent to a Giant Gold Project"

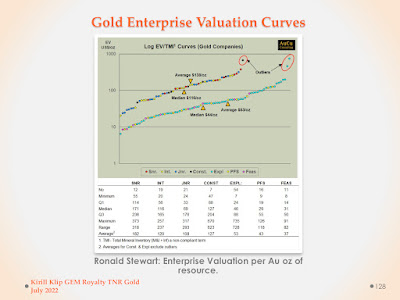

"The Los Azules royalty, according to some calculations, may be worth as much as US$30mln. Rob McEwen himself holds a 1.25% NSR royalty over Los Azules, and he’s been putting some pretty punchy numbers around his own interest in his recent video presentations.On the assumption of production of 182,000 tonnes of copper per year from Los Azules, and a ballpark copper price of US$10,000 per tonne, TNR could end up receiving income of upwards of US$6.6mln per year from its royalty." (Alastair Ford)

"We have two great videos from McEwen Mining and Rob McEwen to share with you today. TNR Gold shareholders have a new potential valuation reference point for the TNR Gold GEM Royalty portfolio. Rob discusses the Gold and Copper markets and gives great details about different Copper projects in Argentina and their valuations."

In February 2023, Stellantis invested ARS $30 billion, and with additional investment of ARS $42 billion made after the new preliminary economic assessment (PEA) publication, has a total investment of ARS $72 billion.

An aggregate of US $65 million in McEwen Copper was also invested by Rio Tinto’s Venture Nuton in 2022 and 2023,” stated Kirill Klip, TNR’s Chief Executive Officer. “TNR Gold’s vision is aligned with the leaders of innovation among automakers like Stellantis, whose aim is decarbonizing mobility, and mining industry leaders such as Rob McEwen, whose vision is ‘to build a mine for the future, based on regenerative principles that can achieve net zero carbon emissions by 2038’.

“The green energy rEVolution relies on the supply of critical metals like copper; delivering “green copper” to Argentina and the world will contribute to the clean energy transition and electrification of transportation and energy industries.

“The new president of Argentina introduced important government policies aimed at supporting business and unlocking the country’s economic potential. Mining is being recognized as an integral part of this economic development plan providing jobs and enriching local communities.

“Strong team performance of McEwen Copper is accelerating the advance of Los Azules Project towards completing a feasibility study. The Los Azules Project PEA results highlighted the potential to create a very robust leach project, while reducing environmental footprint, and greater environmental and social stewardship sets the Project apart from other potential mine developments.

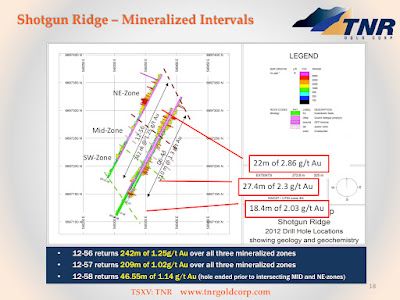

“It’s also very encouraging to see an updated independent mineral resource estimate that has increased significantly. These assay results not only validate previous drilling results but also confirm the continuity of mineralization and extend the mineralization.

“Together with Nuton, McEwen Copper is exploring new technologies that save energy, water, time and capital, advancing Los Azules towards the goal of the leading environmental performance. The involvement of Rio Tinto with its innovative technology, may also accelerate realizing the enormous potential of the Los Azules Project.

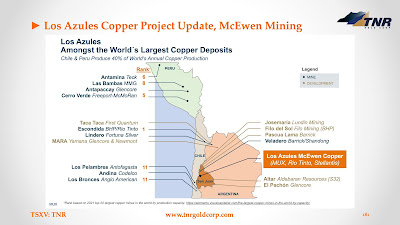

“Los Azules was ranked in the top 10 largest undeveloped copper deposits in the world by Mining Intelligence (2022). TNR Gold does not have to contribute any capital for the development of the Los Azules Project. The essence of our business model is to have industry leaders like McEwen Mining as operators on the projects that will potentially generate royalty cashflows to contribute significant value for our shareholders.”

For all TNR Gold shareholders the part at 36" will be particularly interesting. According to Rob: "Osisko went into Ecuador recently and paid USD$50 million for 0.6% NSR Royalty on the deposit which is smaller than Los Azules. So, that will put just a Los Azules NSR Royalty worth maybe USD$100 million."

"Pursuant to this transaction, McEwen Copper will hold a 100% interest in the Los Azules copper project in San Juan, Argentina, and a 100% interest in the Elder Creek exploration property in Nevada, subject to a 1.25% net smelter return (NSR) royalty on both assets payable to McEwen Mining." McEwen Mining NR July 06, 2021.

"MONTRÉAL, Nov. 07, 2022 (GLOBE NEWSWIRE) — Osisko Gold Royalties Ltd (“Osisko”) (OR: TSX & NYSE) is pleased to announce that it has entered into a binding agreement with SolGold plc (“SolGold”) (SOLG: TSX & LSE) with respect to a US$50 million royalty financing (the “Transaction”) to support the advancement of SolGold’s Cascabel copper-gold property in northeastern Ecuador.

As part of the Transaction, Osisko will acquire a 0.6% net smelter return royalty (the “NSR”) covering the entire 4,979 hectare Cascabel property, including SolGold’s world-class Alpala project for which SolGold released the results of a pre-feasibility study in April of 2022 (the “PFS”)."

McEwen Mining holds 1.25% NSR Royalty on Los Azules Copper which could be valued at USD $100 million based on the Royalty deal made by Osisko Gold Royalties, according to Rob McEwen. TNR Gold Holds 0.4% NSR Royalty on the giant Los Azules Copper, Gold and Silver project with McEwen Mining, of which 0.04% of the 0.4% NSR Royalty is held on behalf of a shareholder.

TNR Gold's 0.36% NSR Royalty could be valued at USD $30 million, based on Rob McEwen's estimations analysing the recent Osisko Gold Royalties deal with SolGold in Ecuador. In the Alastair Ford article, you can find more information about TNR Gold and benchmarks for our GEM Royalty portfolio.